Superannuation Contribution Caps

1. Introduction

There are significant tax concessions provided on contributions paid to superannuation funds. To limit the extent of these concessions, superannuation law also places caps on the amounts that can be contributed each year.

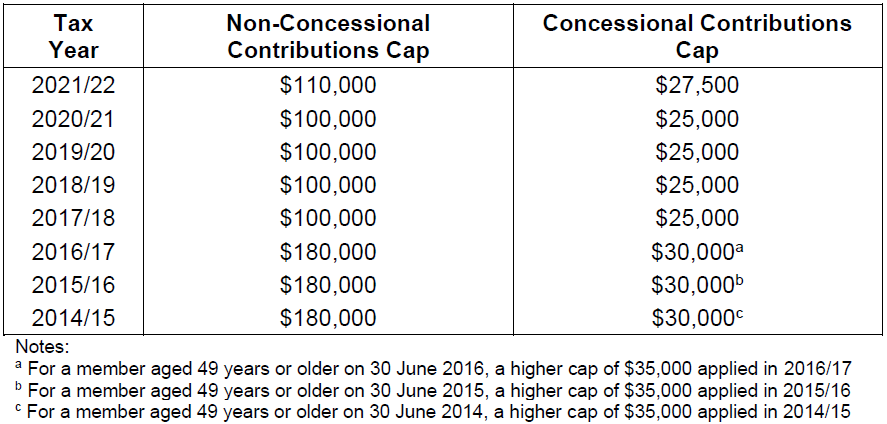

2. Concessional and Non-Concessional Contribution Caps

Concessional contributions are contributions made from before tax income and include

compulsory superannuation guarantee contributions made by your employer, salary sacrifice

contributions and personal contributions where an income tax deduction is claimed. These

contributions are taxed in your super fund at 15%.

Non-concessional contributions are contributions made from after tax income. They include

personal contributions made by you or your spouse for which no income tax deduction is

claimed, and any concessional contributions that exceed your concessional contribution cap.

The amounts of the caps in recent years are summarised in the table below:

3. The Bring-Forward Rule for Non-Concessional Contributions

You may be eligible to use the bring-forward rule to make non-concessional contributions of up

to 3 times the non-concessional contributions cap in the current financial year if you meet certain

requirements. If you trigger the bring-forward rule, then your total non-concessional

contributions cap in the current and next 2 financial years would be limited to 3 times the nonconcessional

contributions cap in the year the bring-forward rule is triggered.

For example, you could use the bring-forward rule to contribute up to $360,000 (i.e. 3 times

$120,000) in 2024/25. If you contributed the full $360,000 in 2024/25, then you would not be

able to make any non-concessional contributions within the cap in 2025/26 or 2026/27. If you

contributed more than $120,000 but less than $360,000 in 2024/25, you could still make further

contributions within the non-concessional contributions cap in 2025/26 and 2026/27, provided

the contributions totalled no more than $360,000 over the three years.

If you triggered the bring-forward rule before 30 June 2017, special transitional rules applied.

To be eligible to use the bring-forward rule, you must satisfy the age requirement on 1 July in the

tax year the bring-forward rule is triggered:

-

For 2022/23 and subsequent tax years, you must be 74 or less on 1 July in the tax year the bring-forward rule is triggered, subject to limitations on age and non-concessional contribution types the fund accepts.

-

For the 2020/21 and 2021/22 tax years, you must be 66 or less on 1 July in the tax year the bring-forward rule is triggered.

-

For the 2019/20 and prior tax years, you must be 64 or less on 1 July in the tax year the bring-forward rule is triggered.

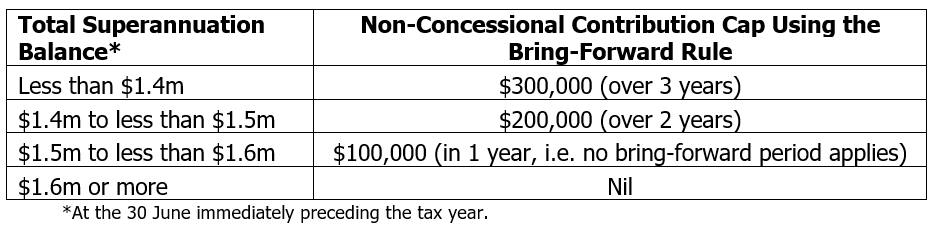

Starting from the 2017/18 tax year, there are also requirements linked to your total superannuation balance to determine if you are eligible to use the bring-forward rule. You cannot make non-concessional contributions in a tax year if you have a total superannuation balance of more than the general transfer balance cap on the 30 June that immediately precedes the tax year. In addition, if your total superannuation balance is approaching the transfer balance cap, then your ability to use the bring-forward rule is reduced:

4. The Carry-Forward Rule for Concessional Contributions

From the 2018/19 tax year, you may be able to take advantage of the carry-forward rule: if you

don’t use your full concessional contribution cap in one year, then you can carry forward the

unused amount for up to 5 years. The carry-forward rule also requires that on the 30 June

immediately preceding the tax year in which the higher contribution is made, your total

superannuation balance is less than $500,000.

This rule only applies to unused contribution caps from the 2018/19 and later tax years, so the

first tax year in which you could apply it is 2019/20. For example, if you made concessional

contributions of $19,000 (i.e. $6,000 less than the cap) in 2018/19, then you could make

concessional contributions of up to $31,000 (i.e. $6,000 more than the cap) in 2019/20.

Alternatively, you could make the higher concessional contribution (along with any other

accumulated unused amounts) in any of the 2020/21 to 2023/2024 tax years.

5. Exceeding the Contributions Caps

If you make contributions in excess of the concessional or non-concessional contribution caps, you may have to pay additional tax and a financial penalty.

5.1. Concessional Contributions

If you have excess concessional contributions, then the excess counts towards your personal taxable income. The 15% contributions tax paid by your superannuation fund would be offset against the personal income tax you must pay. Generally, you can elect to withdraw the excess concessional contributions from your super. Excess concessional contributions are also counted towards your non-concessional contribution cap.

5.2. Non-Concessional Contributions

If you made excess non-concessional contributions, you can elect to have them released from

your superannuation fund, along with 85% of an “associated earnings amount”. The associated

earnings amount is usually calculated based on the ATO’s General Interest Charge.

If you elect to withdraw the excess non-concessional contributions, then the associated earnings

amount (but not the excess non-concessional contributions themselves) would be taxable at your

marginal rate, less an offset of 15%.

If you don’t elect to withdraw the excess non-concessional contributions and the associated

earnings amount, they will be taxed at the top marginal tax rate plus the Medicare levy.

6. Other Matters

6.1. Indexation

The concessional contribution cap (starting from $25,000 in 2017/18) is indexed in line with the

Average Weekly Ordinary Time Earnings. However, the cap is only changed when the indexation

takes it above the next $2,500 increment. The first indexation of the concessional contributions

cap under this rule occurred in 2021/22, when it increased to $27,500. It was increased again, to

$30,000, in 2024/25.

From the 2017/18 tax year, the non-concessional contributions cap is set at 4 times the

concessional contributions cap, which means that when the concessional cap is indexed, the

non-concessional cap will also be indexed.

The threshold applying to the total superannuation balance (which is linked to eligibility to make

non-concessional contributions) is indexed in $100,000 increments in line with the Consumer

Price Index. The most recent indexation of the total superannuation balance has occurred in

2024/25, when it increased to $1.9m.

The $500,000 threshold applying to the carry-forward rule is not indexed.

6.2. Caps Applied Per Member

The contribution caps are applied on a per-member basis, which means that if a member is in two or more superannuation funds the caps apply to the aggregate contributions paid by or for that member.

6.3. Age Requirements and the Work Test

There are also limits applying to the ages at which a superannuation fund can accept certain

contributions on your behalf.

For example, in 2022/23, if you are under 75 your fund can accept all types of contributions

(although downsizer contributions can only be made if you are also over age 60). Once you are

over age 75, a superannuation fund can generally only accept compulsory employer

contributions and downsizer contributions.

In some circumstances, you may need to meet a work test (in addition to age-based

requirements) to be eligible to make certain superannuation contributions.

6.4. Limitations

Note that the information in this article does not cover every aspect of the rules around the

contribution caps, superannuation contributions, or superannuation taxes. Similarly, does it not

cover all aspects of the age requirements and the work test applying to superannuation

contributions.

The caps on superannuation contributions are a complex area and you should seek appropriate

professional advice before acting on the information in this article.

The information provided in this document is not financial product advice. It does not take into account your specific

circumstances or needs. While Verus SMSF Actuaries has taken care to ensure that the information is accurate you should

seek appropriate professional advice before acting on any of the information provided.

Updated November 2024